Tability is a cheatcode for goal-driven teams. Set perfect OKRs with AI, stay focused on the work that matters.

What are Investment Management Team OKRs?

The Objective and Key Results (OKR) framework is a simple goal-setting methodology that was introduced at Intel by Andy Grove in the 70s. It became popular after John Doerr introduced it to Google in the 90s, and it's now used by teams of all sizes to set and track ambitious goals at scale.

Formulating strong OKRs can be a complex endeavor, particularly for first-timers. Prioritizing outcomes over projects is crucial when developing your plans.

We've tailored a list of OKRs examples for Investment Management Team to help you. You can look at any of the templates below to get some inspiration for your own goals.

If you want to learn more about the framework, you can read our OKR guide online.

The best tools for writing perfect Investment Management Team OKRs

Here are 2 tools that can help you draft your OKRs in no time.

Tability AI: to generate OKRs based on a prompt

Tability AI allows you to describe your goals in a prompt, and generate a fully editable OKR template in seconds.

- 1. Create a Tability account

- 2. Click on the Generate goals using AI

- 3. Describe your goals in a prompt

- 4. Get your fully editable OKR template

- 5. Publish to start tracking progress and get automated OKR dashboards

Watch the video below to see it in action 👇

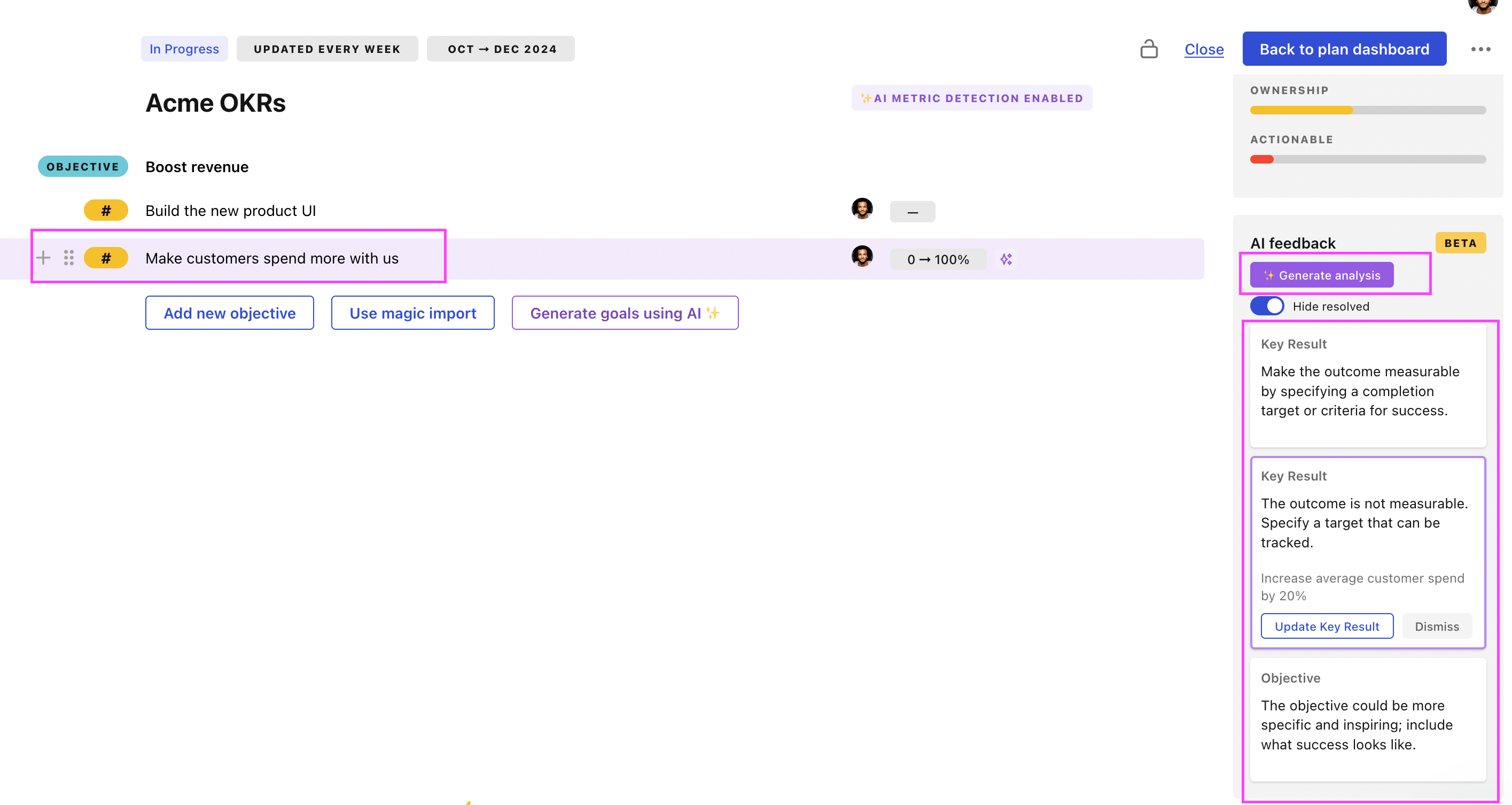

Tability Feedback: to improve existing OKRs

You can use Tability's AI feedback to improve your OKRs if you already have existing goals.

- 1. Create your Tability account

- 2. Add your existing OKRs (you can import them from a spreadsheet)

- 3. Click on Generate analysis

- 4. Review the suggestions and decide to accept or dismiss them

- 5. Publish to start tracking progress and get automated OKR dashboards

Tability will scan your OKRs and offer different suggestions to improve them. This can range from a small rewrite of a statement to make it clearer to a complete rewrite of the entire OKR.

Investment Management Team OKRs examples

You'll find below a list of Objectives and Key Results templates for Investment Management Team. We also included strategic projects for each template to make it easier to understand the difference between key results and projects.

Hope you'll find this helpful!

OKRs to secure additional significant investment for our basketball team

ObjectiveSecure additional significant investment for our basketball team

KRFinalize and secure financing from at least one new major investor

Set up and conduct meetings with prospective financiers

Compile a comprehensive proposal for potential investors

Finalize agreements and secure the investment

KRPitch investment opportunity and potential returns to 15 interested investors

Craft compelling investment opportunity presentation with potential returns

Identify and contact 15 potential investors for pitching

Schedule and conduct investment pitches

KRIdentify and build relationships with at least 20 potential major investors

Research and create list of 20 potential major investors

Organize meetings to discuss investment opportunities

Initiate contact with investors via emails or calls

OKRs to grow personal net worth to $1M

ObjectiveGrow personal net worth to $1M

KRInvest 30% of income in high-yield, low-risk opportunities

Allocate funds towards selected investment opportunities

Determine the amount equalling 30% of your yearly income

Research high-yield, low-risk investment options

KRIncrease monthly income by 50% through diversifying income streams

Learn and engage in e-commerce or online business opportunities

Explore and invest in a variety of income generating assets

Start a side job or freelance work related to your skills

KRReduce monthly expenses by 20% through budgeting and disciplined spending

Establish a strict weekly budget and stick to it

Cut out unnecessary expenses such as dining out

Regularly review and adjust spending habits

OKRs to strategically invest $25,000 to yield 15% annual returns

ObjectiveStrategically invest $25,000 to yield 15% annual returns

KRCommit $12,500 to diversified mutual or index funds for steady long-term growth

Select a range of mutual or index funds

Regularly monitor fund performance

Allocate $12,500 across chosen funds

KRAllocate $6,250 to high-value stocks with a history of consistent returns

Determine $6,250 investment distribution

Identify high-value stocks with consistent returns

Execute allocation towards identified stocks

KRAssign $6,250 to bonds or other secure investments to hedge against potential losses

Research and identify secure investment options

Decide on bonds or alternative secure investments

Allocate $6,250 towards chosen investments

OKRs to identify high-growth potential public companies for investment

ObjectiveIdentify high-growth potential public companies for investment

KRInvest in top 10 high-performing companies from the analyzed list

Allocate investment funds towards these companies

Research and identify top 10 high-performing companies

Analyze their financial stability and growth potential

KRAnalyze financial reports of shortlisted companies to confirm revenue growth

Identify and calculate each company's revenue growth

Compare and contrast the revenue growth among companies

Gather financial reports of selected companies

KRResearch and shortlist 50 public companies with over 20% earnings growth

Identify 50 public companies using market research platforms

Shortlist those with over 20% earnings growth

Analyze their financial records for earning growth

OKRs to drive premium collection rate to 95% for improved investment income

ObjectiveDrive premium collection rate to 95% for improved investment income

KRAchieve steady growth in monthly investment income by 5%

Increase monthly investment amounts by 5%

Regularly rebalance portfolio based on market trends

Diversify investment portfolio in various growth-oriented sectors

KRReduce outstanding premium payments by 20%

Implement automated payment reminders for customers

Offer incentives for early or regular payments

Develop convenient digital premium payment options

KRIncrease monthly premium collection rates by 15%

Conduct premium audits to identify inaccuracies

Implement an effective reward program for consistent payers

Send reminders before each payment's due date

OKRs to grow personal net worth to $1m through strategic investments and savings

ObjectiveGrow personal net worth to $1m through strategic investments and savings

KRInvest 30% of saved income wisely in high-yield platforms

Allocate 30% of saved income for investment

Strategically invest funds in chosen platforms

Identify high-yield investment platforms with a good reputation

KRLimit expenses to save 50% of each month's income

Establish a consistent habit of depositing savings first

Splurge on necessities only to cut down on extra expenses

Consider cost-effective versions of daily used items

KRIncrease passive income by 30% through evaluation and portfolio diversification

Research diverse investment opportunities for higher returns

Analyze current portfolio to identify underperforming assets

Allocate investments strategically to profitable assets

OKRs to establish consistent monthly earnings through cryptocurrency investments

ObjectiveEstablish consistent monthly earnings through cryptocurrency investments

KRInvest in 3 diverse cryptocurrencies, aiming for 10% positive return

Research and select three diverse cryptocurrencies to invest in

Set a financial goal aiming for a 10% positive return

Monitor and adjust investments accordingly as market changes

KRAcquire fundamental knowledge on cryptocurrency investment by reading 5 comprehensive books

Summarize key points from each book

Schedule regular reading sessions weekly

Research and select 5 books on cryptocurrency investment

KRTrack investments daily, maintain a monthly profitability above $200

Analyze profitability reports daily

Adjust investments to ensure profits exceed $200

Monitor investment portfolio value each day

Investment Management Team OKR best practices

Generally speaking, your objectives should be ambitious yet achievable, and your key results should be measurable and time-bound (using the SMART framework can be helpful). It is also recommended to list strategic initiatives under your key results, as it'll help you avoid the common mistake of listing projects in your KRs.

Here are a couple of best practices extracted from our OKR implementation guide 👇

Tip #1: Limit the number of key results

Having too many OKRs is the #1 mistake that teams make when adopting the framework. The problem with tracking too many competing goals is that it will be hard for your team to know what really matters.

We recommend having 3-4 objectives, and 3-4 key results per objective. A platform like Tability can run audits on your data to help you identify the plans that have too many goals.

Tip #2: Commit to weekly OKR check-ins

Setting good goals can be challenging, but without regular check-ins, your team will struggle to make progress. We recommend that you track your OKRs weekly to get the full benefits from the framework.

Being able to see trends for your key results will also keep yourself honest.

Tip #3: No more than 2 yellow statuses in a row

Yes, this is another tip for goal-tracking instead of goal-setting (but you'll get plenty of OKR examples above). But, once you have your goals defined, it will be your ability to keep the right sense of urgency that will make the difference.

As a rule of thumb, it's best to avoid having more than 2 yellow/at risk statuses in a row.

Make a call on the 3rd update. You should be either back on track, or off track. This sounds harsh but it's the best way to signal risks early enough to fix things.

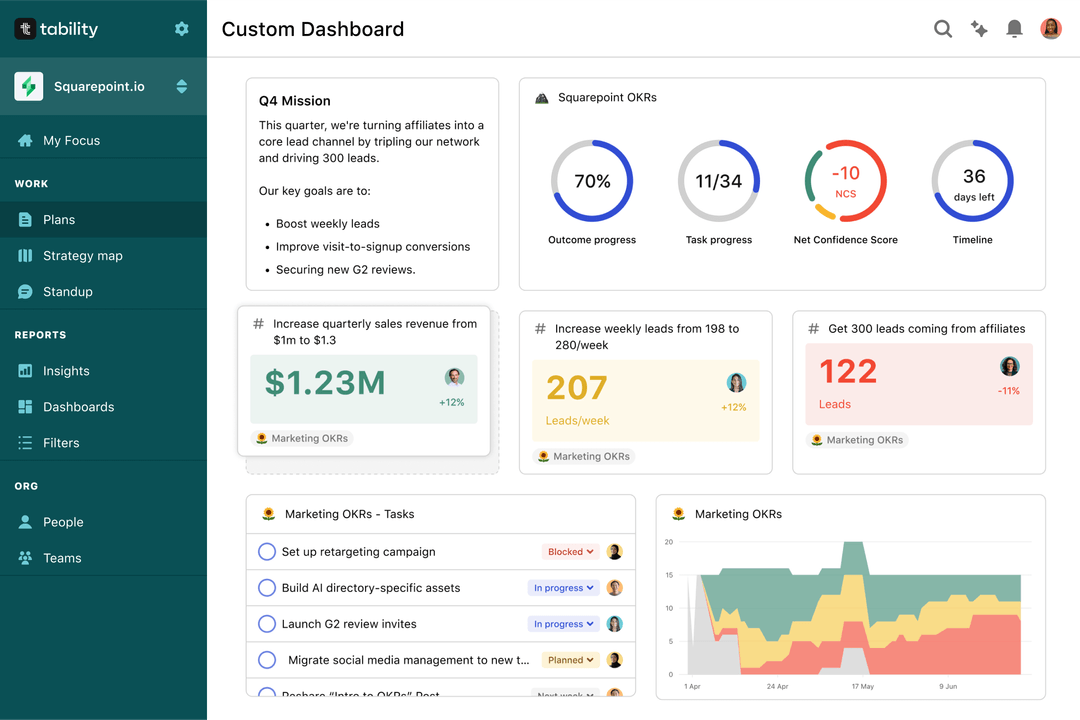

Save hours with automated Investment Management Team OKR dashboards

Your quarterly OKRs should be tracked weekly if you want to get all the benefits of the OKRs framework. Reviewing progress periodically has several advantages:

- It brings the goals back to the top of the mind

- It will highlight poorly set OKRs

- It will surface execution risks

- It improves transparency and accountability

Spreadsheets are enough to get started. Then, once you need to scale you can use Tability to save time with automated OKR dashboards, data connectors, and actionable insights.

How to get Tability dashboards:

- 1. Create a Tability account

- 2. Use the importers to add your OKRs (works with any spreadsheet or doc)

- 3. Publish your OKR plan

That's it! Tability will instantly get access to 10+ dashboards to monitor progress, visualise trends, and identify risks early.

More Investment Management Team OKR templates

We have more templates to help you draft your team goals and OKRs.

OKRs to to expand my understanding of royalties

OKRs to implement cacao fermentation processes in all haciendas

OKRs to secure a job in product management

OKRs to establish leadership for Stringberry Strategy

OKRs to efficiently ferment cacao in available local farmland

OKRs to streamline and improve existing patch management system