Tability is a cheatcode for goal-driven teams. Set perfect OKRs with AI, stay focused on the work that matters.

What are Pre Seed Funding OKRs?

The Objective and Key Results (OKR) framework is a simple goal-setting methodology that was introduced at Intel by Andy Grove in the 70s. It became popular after John Doerr introduced it to Google in the 90s, and it's now used by teams of all sizes to set and track ambitious goals at scale.

Creating impactful OKRs can be a daunting task, especially for newcomers. Shifting your focus from projects to outcomes is key to successful planning.

We've tailored a list of OKRs examples for Pre Seed Funding to help you. You can look at any of the templates below to get some inspiration for your own goals.

If you want to learn more about the framework, you can read our OKR guide online.

The best tools for writing perfect Pre Seed Funding OKRs

Here are 2 tools that can help you draft your OKRs in no time.

Tability AI: to generate OKRs based on a prompt

Tability AI allows you to describe your goals in a prompt, and generate a fully editable OKR template in seconds.

- 1. Create a Tability account

- 2. Click on the Generate goals using AI

- 3. Describe your goals in a prompt

- 4. Get your fully editable OKR template

- 5. Publish to start tracking progress and get automated OKR dashboards

Watch the video below to see it in action 👇

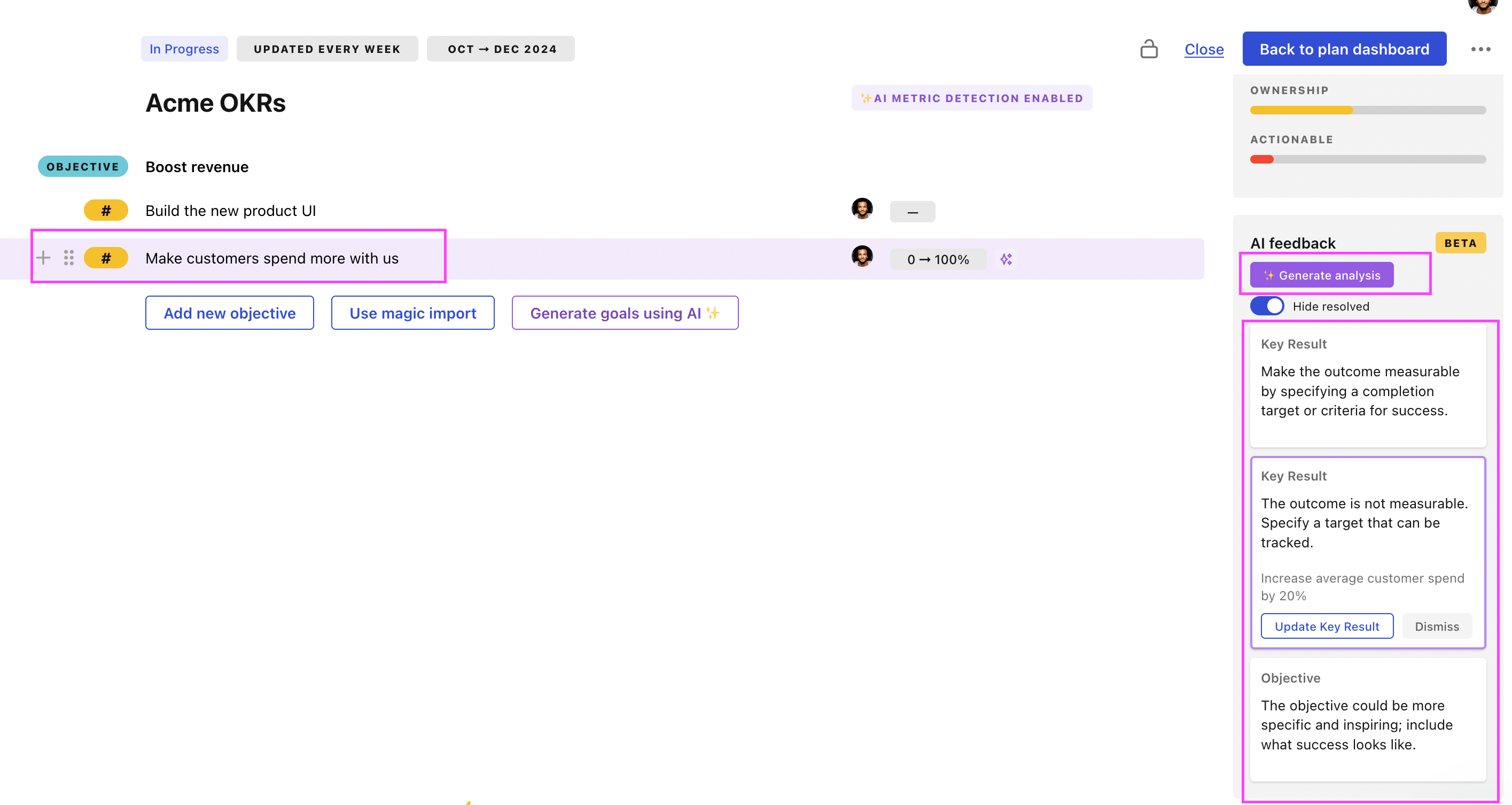

Tability Feedback: to improve existing OKRs

You can use Tability's AI feedback to improve your OKRs if you already have existing goals.

- 1. Create your Tability account

- 2. Add your existing OKRs (you can import them from a spreadsheet)

- 3. Click on Generate analysis

- 4. Review the suggestions and decide to accept or dismiss them

- 5. Publish to start tracking progress and get automated OKR dashboards

Tability will scan your OKRs and offer different suggestions to improve them. This can range from a small rewrite of a statement to make it clearer to a complete rewrite of the entire OKR.

Pre Seed Funding OKRs examples

We've added many examples of Pre Seed Funding Objectives and Key Results, but we did not stop there. Understanding the difference between OKRs and projects is important, so we also added examples of strategic initiatives that relate to the OKRs.

Hope you'll find this helpful!

OKRs to secure $1 million for the pre-seed funding round

ObjectiveSecure $1 million for the pre-seed funding round

KRIdentify and reach out to 50 potential investors by end of phase 1

Initiate contact with each investor through personalized emails

Research and locate contact information for identified investors

Identify 50 potential investors using business directories or networking

KRAchieve commitment for investment from minimum 50% met investors by final phase

Negotiate and finalize investment commitments from participating investors

Create a compelling presentation for potential investors

Schedule and conduct regular meetings with interested investors

KRSecure meetings with at least 25% of identified investors by phase 2

Create a persuasive investment proposal

Schedule and arrange meetings with identified investors

Identify and research potential investors for pitching

Pre Seed Funding OKR best practices

Generally speaking, your objectives should be ambitious yet achievable, and your key results should be measurable and time-bound (using the SMART framework can be helpful). It is also recommended to list strategic initiatives under your key results, as it'll help you avoid the common mistake of listing projects in your KRs.

Here are a couple of best practices extracted from our OKR implementation guide 👇

Tip #1: Limit the number of key results

Having too many OKRs is the #1 mistake that teams make when adopting the framework. The problem with tracking too many competing goals is that it will be hard for your team to know what really matters.

We recommend having 3-4 objectives, and 3-4 key results per objective. A platform like Tability can run audits on your data to help you identify the plans that have too many goals.

Tip #2: Commit to weekly OKR check-ins

Setting good goals can be challenging, but without regular check-ins, your team will struggle to make progress. We recommend that you track your OKRs weekly to get the full benefits from the framework.

Being able to see trends for your key results will also keep yourself honest.

Tip #3: No more than 2 yellow statuses in a row

Yes, this is another tip for goal-tracking instead of goal-setting (but you'll get plenty of OKR examples above). But, once you have your goals defined, it will be your ability to keep the right sense of urgency that will make the difference.

As a rule of thumb, it's best to avoid having more than 2 yellow/at risk statuses in a row.

Make a call on the 3rd update. You should be either back on track, or off track. This sounds harsh but it's the best way to signal risks early enough to fix things.

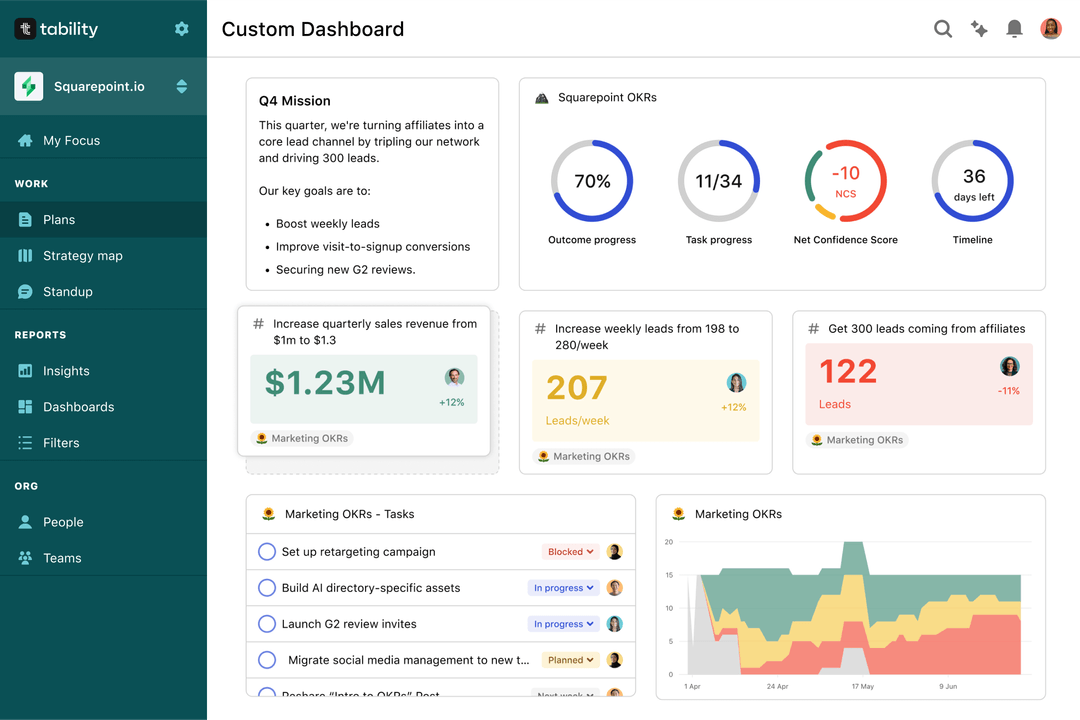

Save hours with automated Pre Seed Funding OKR dashboards

The rules of OKRs are simple. Quarterly OKRs should be tracked weekly, and yearly OKRs should be tracked monthly. Reviewing progress periodically has several advantages:

- It brings the goals back to the top of the mind

- It will highlight poorly set OKRs

- It will surface execution risks

- It improves transparency and accountability

Most teams should start with a spreadsheet if they're using OKRs for the first time. Then, you can move to Tability to save time with automated OKR dashboards, data connectors, and actionable insights.

How to get Tability dashboards:

- 1. Create a Tability account

- 2. Use the importers to add your OKRs (works with any spreadsheet or doc)

- 3. Publish your OKR plan

That's it! Tability will instantly get access to 10+ dashboards to monitor progress, visualise trends, and identify risks early.

More Pre Seed Funding OKR templates

We have more templates to help you draft your team goals and OKRs.

OKRs to to improve academic performance and achieve higher grades

OKRs to elevate team agility and uphold quality

OKRs to accelerate understanding and mastery of company's business and processes

OKRs to successfully execute SEO projects for improved online visibility

OKRs to enhance interaction and engagement on our social media platforms

OKRs to scale the team by hiring and onboarding key talent to support business expansion