Tability is a cheatcode for goal-driven teams. Set perfect OKRs with AI, stay focused on the work that matters.

What are Investor Relations Team OKRs?

The OKR acronym stands for Objectives and Key Results. It's a goal-setting framework that was introduced at Intel by Andy Grove in the 70s, and it became popular after John Doerr introduced it to Google in the 90s. OKRs helps teams has a shared language to set ambitious goals and track progress towards them.

Formulating strong OKRs can be a complex endeavor, particularly for first-timers. Prioritizing outcomes over projects is crucial when developing your plans.

We've tailored a list of OKRs examples for Investor Relations Team to help you. You can look at any of the templates below to get some inspiration for your own goals.

If you want to learn more about the framework, you can read our OKR guide online.

The best tools for writing perfect Investor Relations Team OKRs

Here are 2 tools that can help you draft your OKRs in no time.

Tability AI: to generate OKRs based on a prompt

Tability AI allows you to describe your goals in a prompt, and generate a fully editable OKR template in seconds.

- 1. Create a Tability account

- 2. Click on the Generate goals using AI

- 3. Describe your goals in a prompt

- 4. Get your fully editable OKR template

- 5. Publish to start tracking progress and get automated OKR dashboards

Watch the video below to see it in action 👇

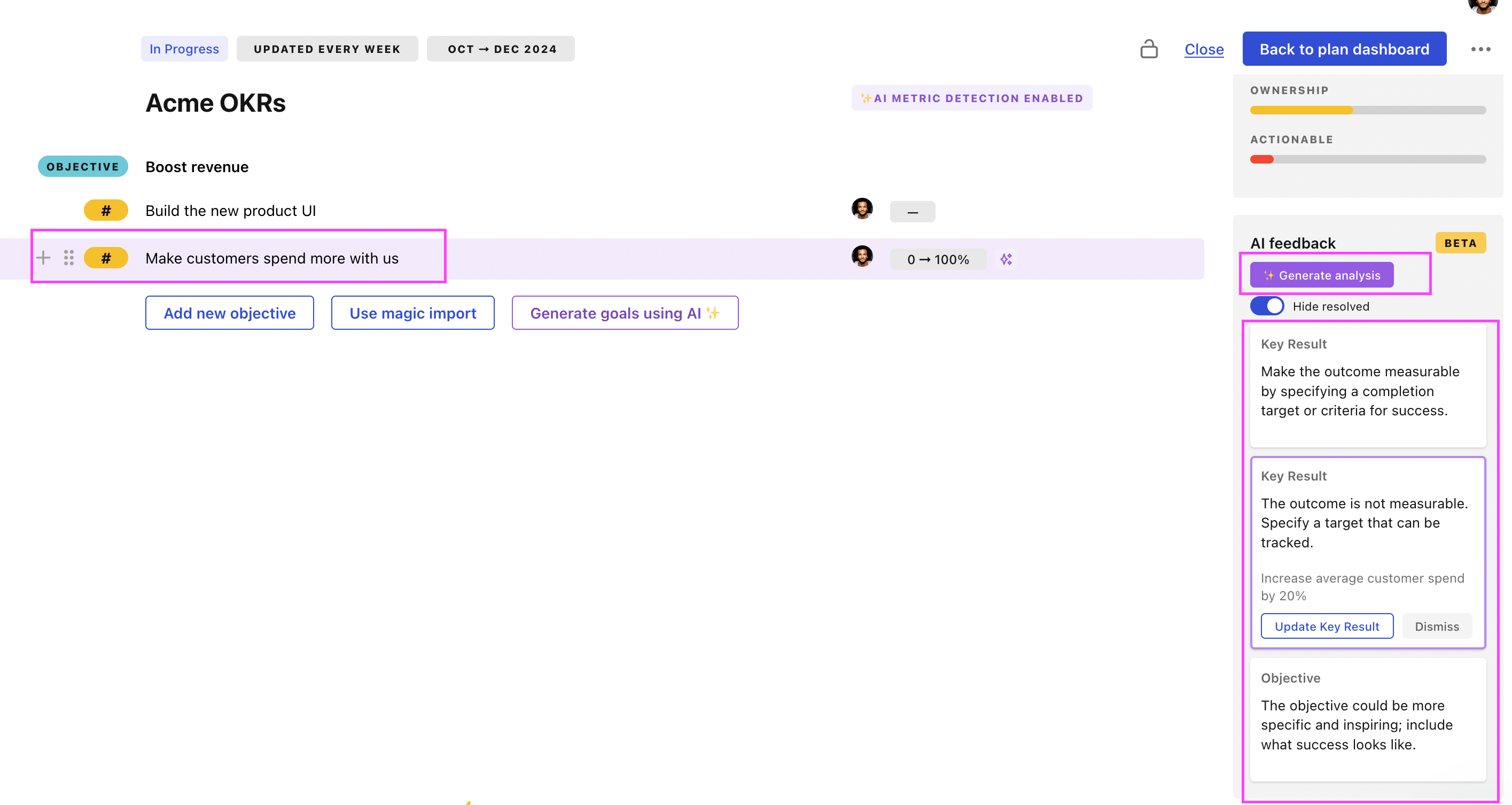

Tability Feedback: to improve existing OKRs

You can use Tability's AI feedback to improve your OKRs if you already have existing goals.

- 1. Create your Tability account

- 2. Add your existing OKRs (you can import them from a spreadsheet)

- 3. Click on Generate analysis

- 4. Review the suggestions and decide to accept or dismiss them

- 5. Publish to start tracking progress and get automated OKR dashboards

Tability will scan your OKRs and offer different suggestions to improve them. This can range from a small rewrite of a statement to make it clearer to a complete rewrite of the entire OKR.

Investor Relations Team OKRs examples

You'll find below a list of Objectives and Key Results templates for Investor Relations Team. We also included strategic projects for each template to make it easier to understand the difference between key results and projects.

Hope you'll find this helpful!

OKRs to establish a robust internal investor relations framework

ObjectiveEstablish a robust internal investor relations framework

KROrganize 10+ meetings with internal stakeholders to communicate the strategy

Identify relevant stakeholders for strategy communication

Schedule 10+ meetings via online platform or in person

Prepare a detailed strategy presentation

KRIdentify and onboard a dedicated investor relations manager with relevant experience

Shortlist, interview, and select a qualified individual

Advertise the position on ideal recruitment platforms

Define the role, skills, and experience needed for the position

KRCreate a comprehensive investor relations strategy document by end of Q1

Identify key insights and information for the strategy document

Draft document outlining investor relations strategy

Finalize and proofread document before deadline

OKRs to secure $1 million for the pre-seed funding round

ObjectiveSecure $1 million for the pre-seed funding round

KRIdentify and reach out to 50 potential investors by end of phase 1

Initiate contact with each investor through personalized emails

Research and locate contact information for identified investors

Identify 50 potential investors using business directories or networking

KRAchieve commitment for investment from minimum 50% met investors by final phase

Negotiate and finalize investment commitments from participating investors

Create a compelling presentation for potential investors

Schedule and conduct regular meetings with interested investors

KRSecure meetings with at least 25% of identified investors by phase 2

Create a persuasive investment proposal

Schedule and arrange meetings with identified investors

Identify and research potential investors for pitching

OKRs to develop a cohesive investor relations strategy for effective fundraising

ObjectiveDevelop a cohesive investor relations strategy for effective fundraising

KRSecure commitments for fundraising from 5 potential investors following strategy implementation

Schedule and conduct meetings with potential stakeholders

Obtain written commitments from investors

Craft persuasive, personalized pitches for potential investors

KRTrain 80% of team on strategy execution for secure investor communication

Monitor and ensure 80% team participation in training

Identify team members needing strategy execution training

Schedule training sessions on secure investor communication

KRCreate strategy document involving all departments within 1 month

Identify key stakeholders across all departments

Schedule meetings to discuss strategies

Write and revise comprehensive strategy document

OKRs to enhance investor relations operations to drive excellence and stakeholder satisfaction

ObjectiveEnhance investor relations operations to drive excellence and stakeholder satisfaction

KRAchieve 90% accuracy in timely reporting and dissemination of investor-related information

Provide training and resources to ensure all staff members understand and follow reporting protocols

Implement an efficient system for tracking and organizing investor-related information

Establish clear guidelines and deadlines for reporting and disseminating investor information

Regularly monitor and review the accuracy of investor-related information before dissemination

KRImprove investor satisfaction rating to 4.5 out of 5 through effective feedback and responsiveness

Establish a streamlined communication channel to provide timely updates and responses to investors

Assign dedicated staff to promptly address investor inquiries and concerns

Conduct training programs for employees on effective feedback techniques and responsiveness to enhance investor satisfaction

Implement regular investor surveys to gather feedback on satisfaction rating and identify areas for improvement

KRIncrease investor confidence by reducing average response time for inquiries by 30%

Streamline internal communication channels to ensure swift resolution of investor inquiries

Train customer support team to prioritize and respond promptly to investor inquiries

Regularly monitor and analyze response times to identify areas for improvement and optimization

Implement automated email templates for frequently asked investor inquiries

KRIncrease investor engagement by 20% through proactive communication and targeted outreach

Conduct personalized phone calls to address specific investor queries and provide support

Host monthly webinars to update investors on market trends and the company's progress

Develop a quarterly newsletter with updates, performance metrics, and investment opportunities

Expand social media presence to share regular updates, industry insights, and engage with investors

OKRs to secure funding for mobile game prototype

ObjectiveSecure funding for mobile game prototype

KRResearch and identify 100 viable investors for gaming prototype by week 6

KRDevelop and perfect a unique and engaging pitch for potential funders by week 3

Identify unique selling points of the project

Practice the pitch for fluid delivery

Create a compelling narrative for the pitch

KRSecure meetings and present pitch to at least 50% of identified investors

Prepare and rehearse investor pitch

Compile contacts of identified investors

Schedule meetings with each investor

OKRs to secure series A financing

ObjectiveSecure series A financing

KRDevelop a compelling business plan and pitch deck

Conduct market research and identify target audience for business plan

Incorporate financial projections and ROI analysis to support the business plan and pitch deck

Clearly outline the problem, solution, and value proposition in the business plan

Create a visually appealing pitch deck with concise and engaging content

KRAchieve a 10% increase in investor meetings

Establish and maintain relationships with key industry influencers and networks to expand investor connections

Increase outreach efforts to potential investors through targeted email campaigns

Develop and deliver compelling presentations to attract investor interest and secure meetings

Utilize social media platforms to promote our company and engage with potential investors

KRIncrease investor outreach by 50%

Create personalized email campaigns for targeted investor segments

Develop a comprehensive database of potential investors

Leverage social media platforms to engage with potential investors and share updates

Schedule regular investor meetings and webinar sessions to disseminate information

KRReceive positive feedback from at least 75% of the potential investors

Conduct thorough research on potential investors to understand their interests and preferences

Follow up with investors promptly, addressing any questions or concerns they may have

Deliver a compelling and concise presentation that clearly communicates the value proposition

Tailor pitch deck to highlight benefits and potential returns for investors

OKRs to boost funding penetration to stride towards the 10% goal

ObjectiveBoost funding penetration to stride towards the 10% goal

KRIncrease funding proposals by 20% attracting new investors

Develop multi-channel marketing strategy for funding proposals

Strengthen network relationships for increased investor interest

Introduce innovative projects to attract fresh investors

KRImprove approval rate of proposals by 30% with persuasive pitches

Improve team skills by organizing frequent sales pitch training

Conduct research on successful strategies for persuasive pitching

Gather feedback and continuously refine the pitch content and delivery

KRMaintain a 10% increase in total funding secured each month

Regularly communicate updates to current investors

Research and identify potential new investors weekly

Develop and refine the pitch deck continuously

OKRs to successfully launch startup

ObjectiveSuccessfully launch startup

KRSecure initial funding of at least $50K

Set up pitches with interested investors

Develop a detailed business plan highlighting investment value

Identify potential investors in the chosen industry

KRAchieve steady user growth rate of 20% month on month

Identify and target a specific user demographic via social media campaigns

Implement a customer referral program with incentives

Optimize SEO strategies for increased organic user traffic

KROnboard first 100 users

Provide personalized support for early users

Launch marketing campaign to attract initial users

Develop a comprehensive, user-friendly onboarding guide

OKRs to raise 1 Million US Dollars as seed funding

ObjectiveRaise 1 Million US Dollars as seed funding

KRIdentify and pitch to 50 potential investors in targeted industries

Create a comprehensive list of 50 potential investors in targeted industries

Research each investor's interests, prioritizing those aligned with our company

Develop and customize pitches tailored to each potential investor

KRSecure commitments from 10 investors at an average of $100,000 each

Schedule individual meetings to present pitch

Identify 20 potential investors for initial outreach

Prepare a persuasive investment pitch

KRExecute fundraising events/campaigns generating $200,000 in total

Organize high-donor events and peer-to-peer fundraising campaigns

Implement donor stewardship plan to encourage repeat contributions

Develop a comprehensive fundraising strategy targeting a $200,000 goal

OKRs to ensure readiness for Series A investment

ObjectiveEnsure readiness for Series A investment

KRAttract and negotiate term sheets with at least three potential Series A investors

Prepare and provide investment presentations and term sheets

Organize and conduct negotiations with potential investors

Research and build relationships with prospective Series A investors

KRDevelop and finalize investment pitch deck highlighting business model and growth strategy

Review, refine, and finalize investment pitch deck

Outline business model and growth strategy in detail

Draft original content for pitch deck

KRSecure financial audit report showcasing positive EBITDA and revenue growth

Prepare clear report highlighting EBITDA and revenue growth

Arrange for an external, unbiased financial audit

Compile all relevant financial documents and data

Investor Relations Team OKR best practices

Generally speaking, your objectives should be ambitious yet achievable, and your key results should be measurable and time-bound (using the SMART framework can be helpful). It is also recommended to list strategic initiatives under your key results, as it'll help you avoid the common mistake of listing projects in your KRs.

Here are a couple of best practices extracted from our OKR implementation guide 👇

Tip #1: Limit the number of key results

Having too many OKRs is the #1 mistake that teams make when adopting the framework. The problem with tracking too many competing goals is that it will be hard for your team to know what really matters.

We recommend having 3-4 objectives, and 3-4 key results per objective. A platform like Tability can run audits on your data to help you identify the plans that have too many goals.

Tip #2: Commit to weekly OKR check-ins

Setting good goals can be challenging, but without regular check-ins, your team will struggle to make progress. We recommend that you track your OKRs weekly to get the full benefits from the framework.

Being able to see trends for your key results will also keep yourself honest.

Tip #3: No more than 2 yellow statuses in a row

Yes, this is another tip for goal-tracking instead of goal-setting (but you'll get plenty of OKR examples above). But, once you have your goals defined, it will be your ability to keep the right sense of urgency that will make the difference.

As a rule of thumb, it's best to avoid having more than 2 yellow/at risk statuses in a row.

Make a call on the 3rd update. You should be either back on track, or off track. This sounds harsh but it's the best way to signal risks early enough to fix things.

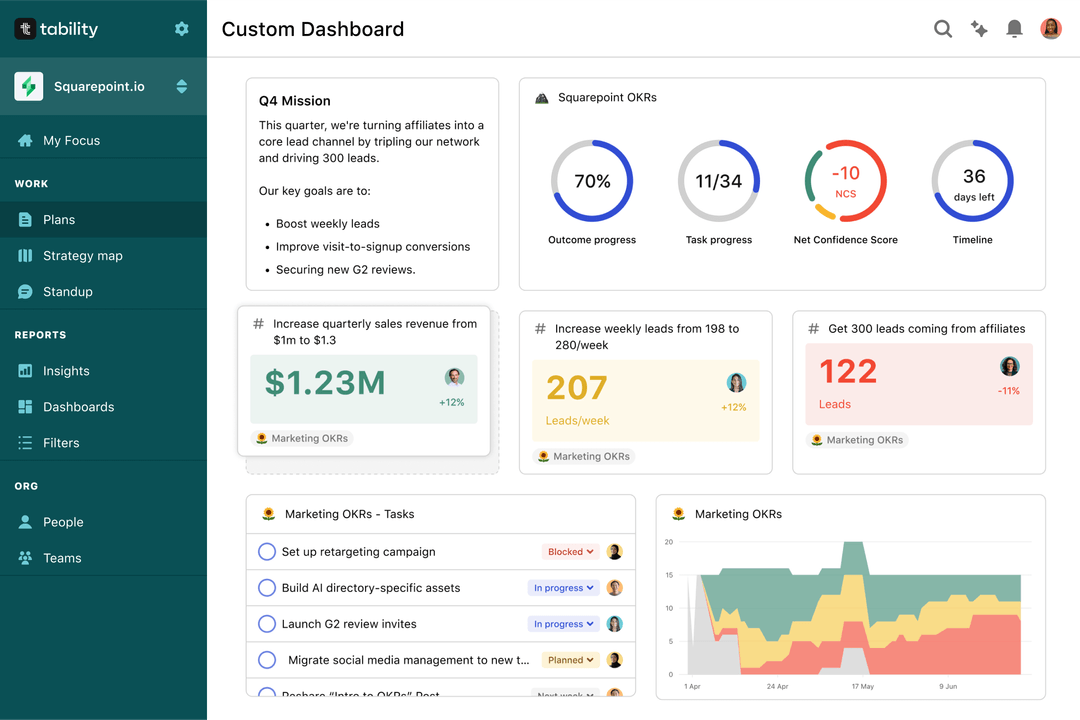

Save hours with automated Investor Relations Team OKR dashboards

OKRs without regular progress updates are just KPIs. You'll need to update progress on your OKRs every week to get the full benefits from the framework. Reviewing progress periodically has several advantages:

- It brings the goals back to the top of the mind

- It will highlight poorly set OKRs

- It will surface execution risks

- It improves transparency and accountability

Spreadsheets are enough to get started. Then, once you need to scale you can use Tability to save time with automated OKR dashboards, data connectors, and actionable insights.

How to get Tability dashboards:

- 1. Create a Tability account

- 2. Use the importers to add your OKRs (works with any spreadsheet or doc)

- 3. Publish your OKR plan

That's it! Tability will instantly get access to 10+ dashboards to monitor progress, visualise trends, and identify risks early.

More Investor Relations Team OKR templates

We have more templates to help you draft your team goals and OKRs.

OKRs to enhance technical proficiency and efficiency as a Cloud Architect

OKRs to execute a systematic approach to generate varying okr timelines

OKRs to enhance nonprofits' performance through capacity-strengthening interventions

OKRs to maximize fleet operational efficiency

OKRs to attain a 90 pass mark by end of first 9 weeks

OKRs to strengthen strategic alignment across all business units