Tability is a cheatcode for goal-driven teams. Set perfect OKRs with AI, stay focused on the work that matters.

What are Reporting Officer OKRs?

The OKR acronym stands for Objectives and Key Results. It's a goal-setting framework that was introduced at Intel by Andy Grove in the 70s, and it became popular after John Doerr introduced it to Google in the 90s. OKRs helps teams has a shared language to set ambitious goals and track progress towards them.

Formulating strong OKRs can be a complex endeavor, particularly for first-timers. Prioritizing outcomes over projects is crucial when developing your plans.

We've tailored a list of OKRs examples for Reporting Officer to help you. You can look at any of the templates below to get some inspiration for your own goals.

If you want to learn more about the framework, you can read our OKR guide online.

The best tools for writing perfect Reporting Officer OKRs

Here are 2 tools that can help you draft your OKRs in no time.

Tability AI: to generate OKRs based on a prompt

Tability AI allows you to describe your goals in a prompt, and generate a fully editable OKR template in seconds.

- 1. Create a Tability account

- 2. Click on the Generate goals using AI

- 3. Describe your goals in a prompt

- 4. Get your fully editable OKR template

- 5. Publish to start tracking progress and get automated OKR dashboards

Watch the video below to see it in action 👇

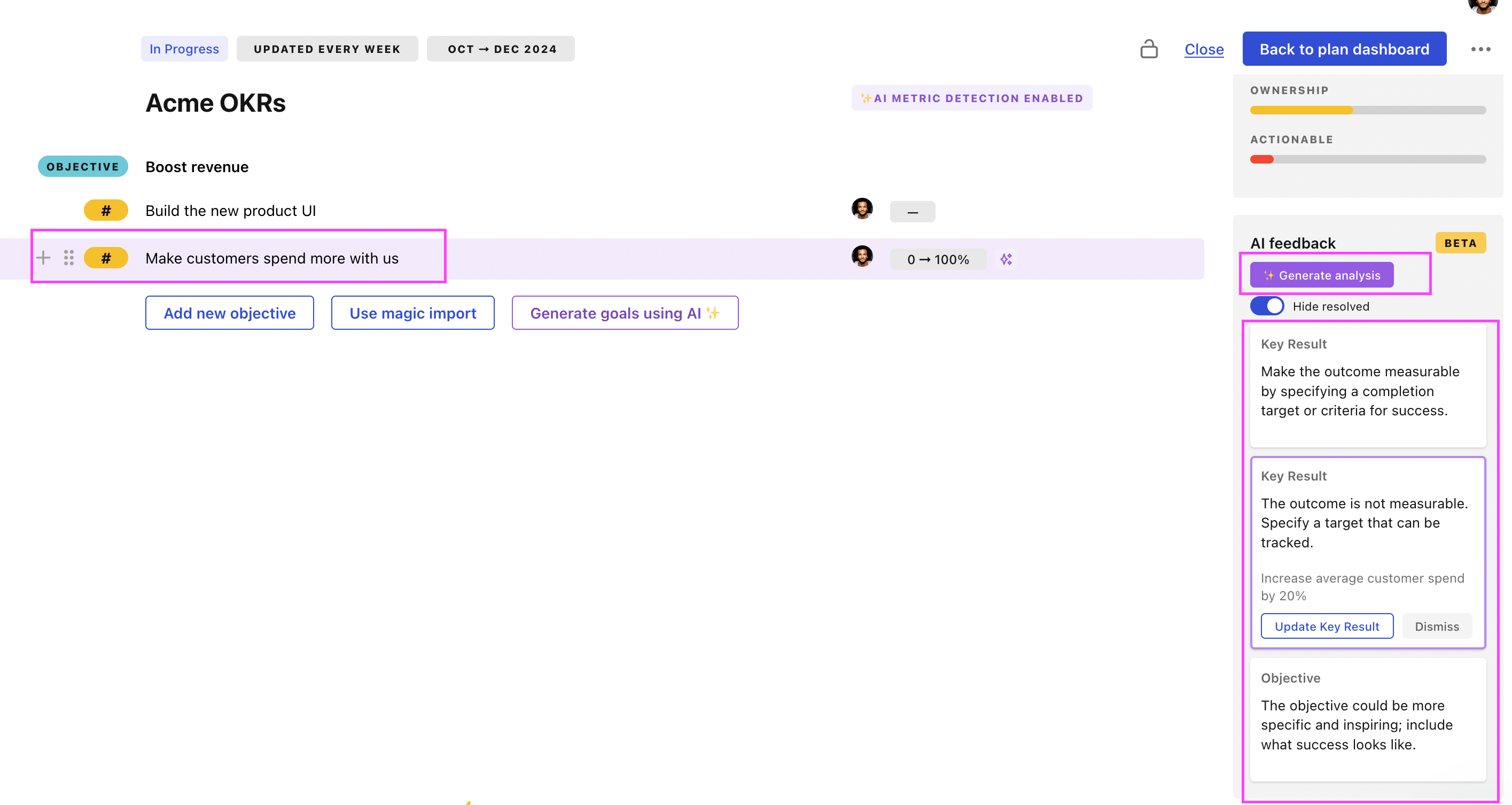

Tability Feedback: to improve existing OKRs

You can use Tability's AI feedback to improve your OKRs if you already have existing goals.

- 1. Create your Tability account

- 2. Add your existing OKRs (you can import them from a spreadsheet)

- 3. Click on Generate analysis

- 4. Review the suggestions and decide to accept or dismiss them

- 5. Publish to start tracking progress and get automated OKR dashboards

Tability will scan your OKRs and offer different suggestions to improve them. This can range from a small rewrite of a statement to make it clearer to a complete rewrite of the entire OKR.

Reporting Officer OKRs examples

You'll find below a list of Objectives and Key Results templates for Reporting Officer. We also included strategic projects for each template to make it easier to understand the difference between key results and projects.

Hope you'll find this helpful!

OKRs to improve accuracy of financial statement reporting

ObjectiveImprove accuracy of financial statement reporting

KRTrain staff on new financial reporting procedures to ensure 95% compliance

Develop a detailed training program for new financial procedures

Monitor and evaluate staff compliance regularly

Implement regular training sessions for all staff members

KRImplement a comprehensive audit process to decrease reporting errors by 30%

Train staff on proper reporting and audit procedures

Install auditing software to automatically detect errors

Establish a defined auditing protocol involving routine checks

KRImprove data management systems to reduce data-entry errors by 40%

Train staff on proper data-entry techniques

Upgrade data-entry software for better accuracy

Implement comprehensive data validation checks

OKRs to prepare a perfect and precise financial statement

ObjectivePrepare a perfect and precise financial statement

KRImplement a double-verification system for transaction recording by the end of the quarter

Identify suitable double-verification technology options

Roll out double-verification system

Develop implementation and training plan

KRAchieve 100% on-time internal financial reporting with no errors for three consecutive months

Automate reports using reliable financial software

Train staff on accurate and timely data input

Implement a rigorous financial data review process

KREnsure 0% discrepancies in monthly intra-department financial audits throughout the quarter

Implement stringent checks on each financial transaction

Regularly review internal audit processes

Provide comprehensive training on accurate reporting

OKRs to streamline and improve the hiring reporting processes

ObjectiveStreamline and improve the hiring reporting processes

KRReduce errors in hiring reports by at least 20% with quality checks

Implement a double-check system for all hiring reports

Utilize automatic error-detection software

Train staff on error conscious report generation

KRImplement a new recruitment software that reduces report generation time by 30%

Research and select suitable recruitment software

Install and integrate the chosen software

Train staff to utilize new software

KRTrain 100% of HR team on updated hiring reporting procedures

Schedule training sessions for all HR team members

Develop a comprehensive training module for new hiring procedures

Monitor and evaluate team's understanding post-training

OKRs to enhance focus and accountability in Fraud Investigations Department

ObjectiveEnhance focus and accountability in Fraud Investigations Department

KRIncrease cases solved per investigator by 30% through focused team training

Establish performance tracking to measure progress

Implement specialized team training on investigation techniques

Evaluate current investigation strategies for potential improvement

KRAchieve 100% timely status update for ongoing fraud investigations for accountability

Assign a team member responsible for tracking and updating status

Conduct weekly checks to ensure all reports are up-to-date

Implement a daily reporting system for all ongoing fraud investigations

KRImplement advanced fraud detection tools to improve detection rate by 25%

Research available advanced fraud detection tools on the market

Train staff on how to utilize new detection software effectively

Purchase and integrate chosen fraud detection tool into system

OKRs to achieve zero loss time accidents

ObjectiveAchieve zero loss time accidents

KRReduce accident rate by 50% through improved safety training and protocols

Implement comprehensive safety training for all employees

Increase frequency of safety drills

Regularly evaluate and update safety protocols

KRIncrease near-miss report submissions by 30% for proactive hazard identification

Conduct training sessions on importance of near-miss reporting

Implement an easy-to-use digital near-miss reporting system

Reward employees for submitting near-miss reports

KRImplement a safety audit program impacting 100% of operational areas

Implement audits across all operational areas

Design comprehensive safety audit measures

Identify all operational areas for audit inclusion

Reporting Officer OKR best practices

Generally speaking, your objectives should be ambitious yet achievable, and your key results should be measurable and time-bound (using the SMART framework can be helpful). It is also recommended to list strategic initiatives under your key results, as it'll help you avoid the common mistake of listing projects in your KRs.

Here are a couple of best practices extracted from our OKR implementation guide 👇

Tip #1: Limit the number of key results

Having too many OKRs is the #1 mistake that teams make when adopting the framework. The problem with tracking too many competing goals is that it will be hard for your team to know what really matters.

We recommend having 3-4 objectives, and 3-4 key results per objective. A platform like Tability can run audits on your data to help you identify the plans that have too many goals.

Tip #2: Commit to weekly OKR check-ins

Setting good goals can be challenging, but without regular check-ins, your team will struggle to make progress. We recommend that you track your OKRs weekly to get the full benefits from the framework.

Being able to see trends for your key results will also keep yourself honest.

Tip #3: No more than 2 yellow statuses in a row

Yes, this is another tip for goal-tracking instead of goal-setting (but you'll get plenty of OKR examples above). But, once you have your goals defined, it will be your ability to keep the right sense of urgency that will make the difference.

As a rule of thumb, it's best to avoid having more than 2 yellow/at risk statuses in a row.

Make a call on the 3rd update. You should be either back on track, or off track. This sounds harsh but it's the best way to signal risks early enough to fix things.

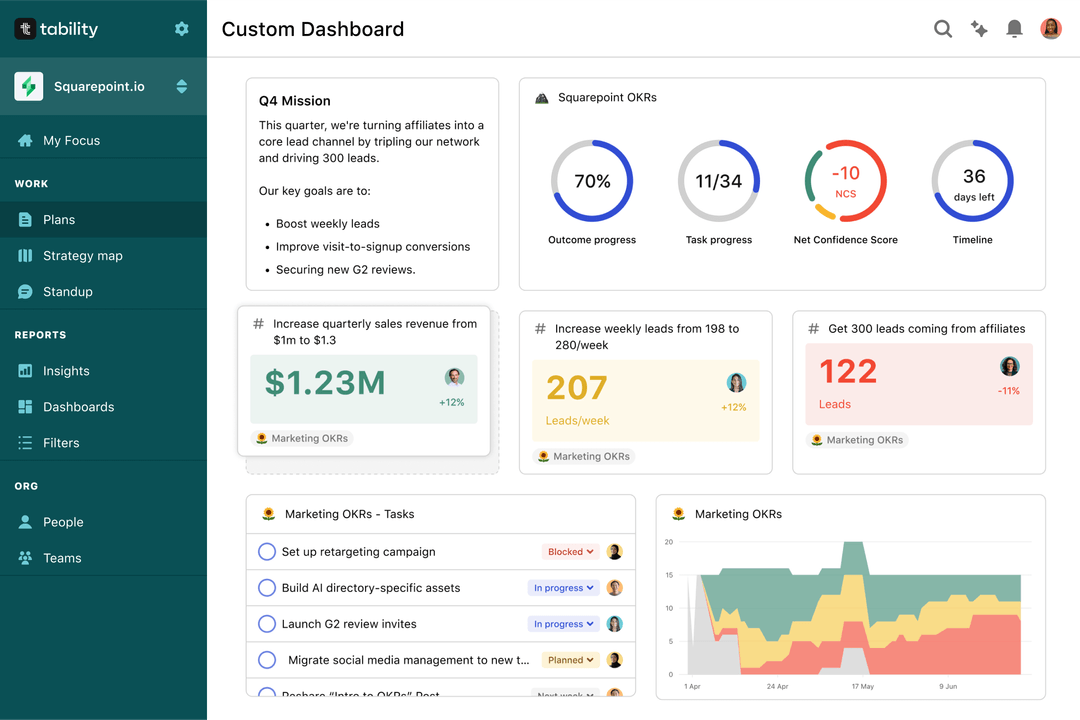

Save hours with automated Reporting Officer OKR dashboards

OKRs without regular progress updates are just KPIs. You'll need to update progress on your OKRs every week to get the full benefits from the framework. Reviewing progress periodically has several advantages:

- It brings the goals back to the top of the mind

- It will highlight poorly set OKRs

- It will surface execution risks

- It improves transparency and accountability

Spreadsheets are enough to get started. Then, once you need to scale you can use Tability to save time with automated OKR dashboards, data connectors, and actionable insights.

How to get Tability dashboards:

- 1. Create a Tability account

- 2. Use the importers to add your OKRs (works with any spreadsheet or doc)

- 3. Publish your OKR plan

That's it! Tability will instantly get access to 10+ dashboards to monitor progress, visualise trends, and identify risks early.

More Reporting Officer OKR templates

We have more templates to help you draft your team goals and OKRs.

OKRs to preserve and augment the company's knowledge base

OKRs to enhance QA analysis of each MCSS in the test repository

OKRs to improve the Disaster Recover process

OKRs to improve utilization rate of employees and resources

OKRs to establish a standard price for raw materials

OKRs to implement phase one of privilege access management tool replacement