Tability is a cheatcode for goal-driven teams. Set perfect OKRs with AI, stay focused on the work that matters.

What are Finance Analyst OKRs?

The OKR acronym stands for Objectives and Key Results. It's a goal-setting framework that was introduced at Intel by Andy Grove in the 70s, and it became popular after John Doerr introduced it to Google in the 90s. OKRs helps teams has a shared language to set ambitious goals and track progress towards them.

Crafting effective OKRs can be challenging, particularly for beginners. Emphasizing outcomes rather than projects should be the core of your planning.

We've tailored a list of OKRs examples for Finance Analyst to help you. You can look at any of the templates below to get some inspiration for your own goals.

If you want to learn more about the framework, you can read our OKR guide online.

The best tools for writing perfect Finance Analyst OKRs

Here are 2 tools that can help you draft your OKRs in no time.

Tability AI: to generate OKRs based on a prompt

Tability AI allows you to describe your goals in a prompt, and generate a fully editable OKR template in seconds.

- 1. Create a Tability account

- 2. Click on the Generate goals using AI

- 3. Describe your goals in a prompt

- 4. Get your fully editable OKR template

- 5. Publish to start tracking progress and get automated OKR dashboards

Watch the video below to see it in action 👇

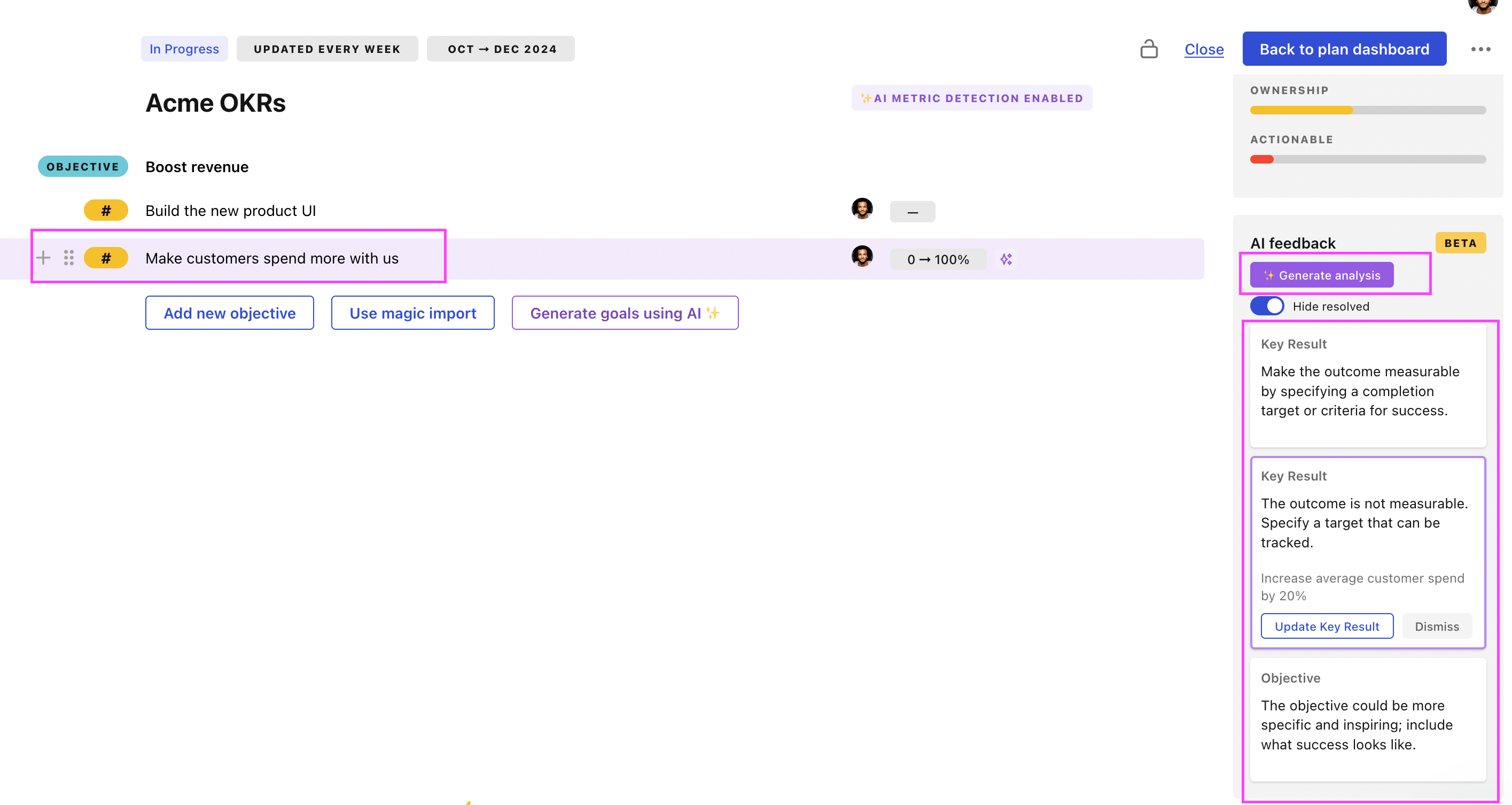

Tability Feedback: to improve existing OKRs

You can use Tability's AI feedback to improve your OKRs if you already have existing goals.

- 1. Create your Tability account

- 2. Add your existing OKRs (you can import them from a spreadsheet)

- 3. Click on Generate analysis

- 4. Review the suggestions and decide to accept or dismiss them

- 5. Publish to start tracking progress and get automated OKR dashboards

Tability will scan your OKRs and offer different suggestions to improve them. This can range from a small rewrite of a statement to make it clearer to a complete rewrite of the entire OKR.

Finance Analyst OKRs examples

You will find in the next section many different Finance Analyst Objectives and Key Results. We've included strategic initiatives in our templates to give you a better idea of the different between the key results (how we measure progress), and the initiatives (what we do to achieve the results).

Hope you'll find this helpful!

OKRs to efficiently manage and optimize our team's budget performance

ObjectiveEfficiently manage and optimize our team's budget performance

KRDeliver 100% accurate budget reports every fortnight for effective tracking

Organize all relevant financial data every two weeks

Develop accurate budget reports from collected data

Submit the completed reports for tracking promptly

KRReduce unnecessary expenditures by 15% for improved budget efficiency

Negotiate with vendors for reduced cost of services

Implement monitoring system for discretionary spending

Identify and eliminate non-essential business expenses

KRIncrease budget ROI by 10% through strategic allocation of resources

Analyze current spending to identify inefficiencies or wasted resources

Implement a strategic plan prioritizing high ROI initiatives

Regularly review and adjust resource allocation as needed

OKRs to attain professional status in trading

ObjectiveAttain professional status in trading

KRTrade a minimum of 300 shares per day for 45 days spread throughout the quarter

Repeat this process for 45 days

Set daily reminder for a trading session

Buy or sell at least 300 shares daily

KRComplete an advanced trading course with a 90% pass rate

Practice mock trading tests for scoring high

Consistently study course materials for understanding

Enroll in an advanced trading course

KRAchieve a consistent profit rate of 10% for 6 consecutive weeks

Regularly analyze profit rates and make necessary adjustments

Implement cost-saving measures and improve operational efficiency

Review and adjust pricing strategies to increase profit margins

OKRs to identify the top FP&A software in the market

ObjectiveIdentify the top FP&A software in the market

KRResearch and list down at least 20 various FP&A software options by week 3

Compile and review a list of at least 20 options

Conduct online research for potential software options

Identify criteria for FP&A software options

KRCompare all FP&A software elements for features, cost, and user reviews by week 6

Compile a list of all FP&A software elements

Analyze user reviews for each software

Evaluate each software for features and cost

KRSelect and present the top 3 FP&A software based on the analysis by week 9

Analyze software based on selected criteria

Research various FP&A software options

Prepare presentation for top three choices

OKRs to establish a robust, efficient new financial structure

ObjectiveEstablish a robust, efficient new financial structure

KRAchieve 20% cost reduction through optimization of financial processes

KRIntegrate advanced digital platforms for efficient monetary transactions by end of quarter

Implement chosen platforms into current systems

Identify advanced digital platforms suitable for monetary transactions

Develop integration strategy for chosen platforms

KRTrain 90% of finance employees on the new financial structure for seamless integration

Monitor training progress to ensure 90% completion rate

Schedule and coordinate with finance employees for their training

Identify suitable training seminars or courses on the new financial structure

OKRs to enhancement of CSR initiatives' financial efficiency and impact

ObjectiveEnhancement of CSR initiatives' financial efficiency and impact

KRSecure 3 new corporate sponsors for ongoing CSR initiatives

Identify potential sponsors within relevant industries

Follow up with potential sponsors for feedback

Prepare and send personalized sponsorship proposals

KRIncrease financial contribution to CSR projects by 20%

Approve and implement the revised financial plan

Identify current CSR projects' budgets and calculate a 20% increase

Review and reallocate the overall budget to accommodate increase

KRAchieve a 10% reduction in administrative costs related to CSR projects

Identify inefficiencies in current CSR project procedures

Implement cost-effective technologies to streamline processes

Train staff on budget optimization practices

OKRs to increase company profitability

ObjectiveIncrease company profitability

KRAchieve a 10% reduction in operating costs through efficiency improvements

Identify wasteful practices in the current operational process

Implement new efficiency-enhancing technologies

Train staff on cost-saving practices and procedures

KRIncrease net revenue by 15% via new customer acquisition strategies

Conduct market research to identify potential customer segments

Offer incentives for referrals to generate new clients

Develop and implement a targeted digital marketing campaign

KRImplement cost-saving measures to decrease overhead expenses by 8%

Develop strategies to reduce miscellaneous office expenditures

Review and analyze current overhead expenses in detail

Optimize energy usage to minimize utility bills

OKRs to formulate a robust 7-year financial plan

ObjectiveFormulate a robust 7-year financial plan

KRFinalize full 7-year financial plan after conducting 3 rounds of reviews by Week 12

Make necessary revisions based on the review feedback

Finalize and approve the 7-year financial plan by Week 12

Conduct 3 rounds of reviews for the 7-year financial plan

KRIdentify and document all major revenue and expense sources by Week 6

Document all major revenue sources

Identify all major revenue sources by Week 6

Record all major expense sources by Week 6

KRCreate projection models and validate accuracy for the first 2 years by Week 9

Validate accuracy of models by Week 9

Develop projection models based on gathered data

Gather data relevant to creating projection models

OKRs to successfully save money to build an investment fund

ObjectiveSuccessfully save money to build an investment fund

KRSet aside 20% of monthly income to a dedicated savings account

Open a separate savings account for monthly deposits

Set up monthly automatic transfers to savings account

Calculate 20% of anticipated monthly income

KRResearch and select 2-3 potential investment opportunities

Conduct thorough research on potential investment opportunities

Define specific criteria for selecting investment opportunities

Choose 2-3 investments that meet your criteria

KRReduce unnecessary expenditure by 15% to increase savings

Identify and eliminate all nonessential expenses

Regularly review and adjust the budget plan

Utilize cash over credit to avoid overspending

OKRs to implement automation for recurring journal entries

ObjectiveImplement automation for recurring journal entries

KRChoose and onboard an automation software/tool by end of the first month

Purchase and install the selected software

Conduct initial setup and staff training

Research and select a suitable automation tool

KRMigrate 50% of recurring entries to the automation system by the second month

Implement necessary changes for automation integration

Achieve 50% automation of recurring entries

Identify recurring entries eligible for automation

KRAchieve 100% accurate automation for all recurring entries by the end of the quarter

Identify all processes involved in managing recurring entries

Regularly audit and refine automation system

Implement automation software tailored to those processes

OKRs to determine sustainable funding requirements for existing programs

ObjectiveDetermine sustainable funding requirements for existing programs

KRPresent findings and implement changes for optimal sustainability by week 12

KRChoose and analyze 3 programs to evaluate their funding sustainability by week 4

Assess the sustainability of their funding by week 4

Select three programs for evaluation

Conduct an analysis of their funding sources

KRDevelop a comprehensive funding structure for each of the selected programs by week 8

Identify budget requirements for selected programs

Research potential funding sources

Draft comprehensive funding plan by week 8

Finance Analyst OKR best practices

Generally speaking, your objectives should be ambitious yet achievable, and your key results should be measurable and time-bound (using the SMART framework can be helpful). It is also recommended to list strategic initiatives under your key results, as it'll help you avoid the common mistake of listing projects in your KRs.

Here are a couple of best practices extracted from our OKR implementation guide 👇

Tip #1: Limit the number of key results

The #1 role of OKRs is to help you and your team focus on what really matters. Business-as-usual activities will still be happening, but you do not need to track your entire roadmap in the OKRs.

We recommend having 3-4 objectives, and 3-4 key results per objective. A platform like Tability can run audits on your data to help you identify the plans that have too many goals.

Tip #2: Commit to weekly OKR check-ins

Don't fall into the set-and-forget trap. It is important to adopt a weekly check-in process to get the full value of your OKRs and make your strategy agile – otherwise this is nothing more than a reporting exercise.

Being able to see trends for your key results will also keep yourself honest.

Tip #3: No more than 2 yellow statuses in a row

Yes, this is another tip for goal-tracking instead of goal-setting (but you'll get plenty of OKR examples above). But, once you have your goals defined, it will be your ability to keep the right sense of urgency that will make the difference.

As a rule of thumb, it's best to avoid having more than 2 yellow/at risk statuses in a row.

Make a call on the 3rd update. You should be either back on track, or off track. This sounds harsh but it's the best way to signal risks early enough to fix things.

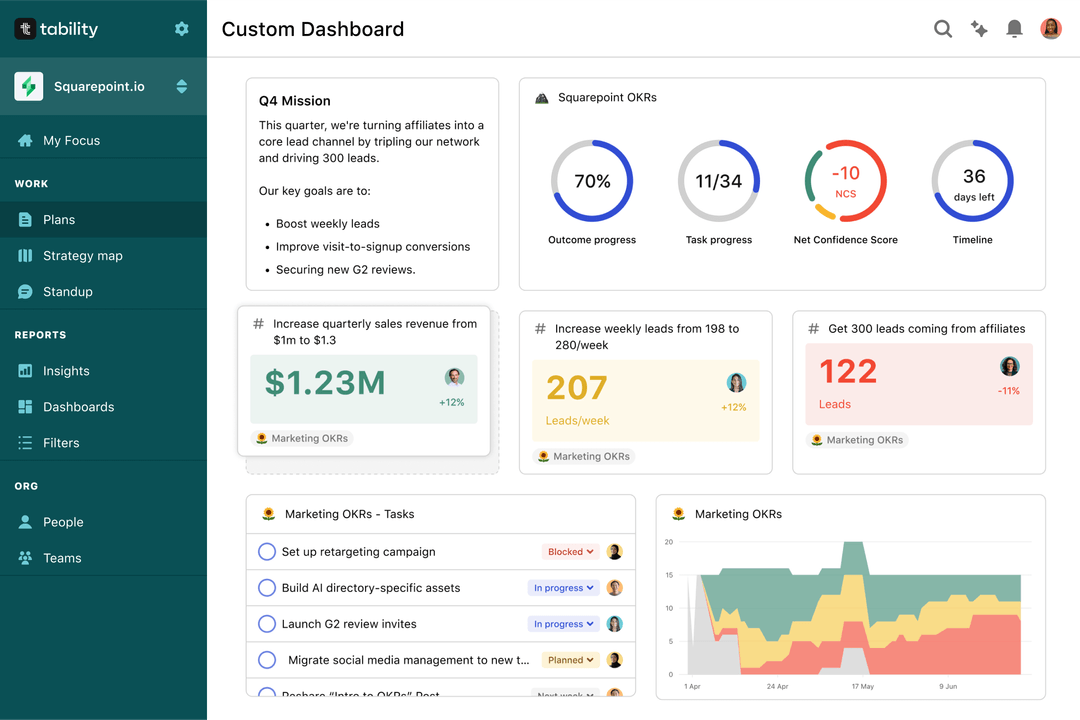

Save hours with automated Finance Analyst OKR dashboards

Your quarterly OKRs should be tracked weekly if you want to get all the benefits of the OKRs framework. Reviewing progress periodically has several advantages:

- It brings the goals back to the top of the mind

- It will highlight poorly set OKRs

- It will surface execution risks

- It improves transparency and accountability

Most teams should start with a spreadsheet if they're using OKRs for the first time. Then, you can move to Tability to save time with automated OKR dashboards, data connectors, and actionable insights.

How to get Tability dashboards:

- 1. Create a Tability account

- 2. Use the importers to add your OKRs (works with any spreadsheet or doc)

- 3. Publish your OKR plan

That's it! Tability will instantly get access to 10+ dashboards to monitor progress, visualise trends, and identify risks early.

More Finance Analyst OKR templates

We have more templates to help you draft your team goals and OKRs.

OKRs to streamline the process for completing monthly billing in a timely manner

OKRs to increase efficiency in budget monitoring and enhance team engagement

OKRs to drive business expansion through innovative strategies

OKRs to develop a comprehensive and user-friendly dictionary

OKRs to enhance efficiency using development platform

OKRs to boost our presence in significant media outlets