Tability is a cheatcode for goal-driven teams. Set perfect OKRs with AI, stay focused on the work that matters.

What are Investor Funding OKRs?

The Objective and Key Results (OKR) framework is a simple goal-setting methodology that was introduced at Intel by Andy Grove in the 70s. It became popular after John Doerr introduced it to Google in the 90s, and it's now used by teams of all sizes to set and track ambitious goals at scale.

Formulating strong OKRs can be a complex endeavor, particularly for first-timers. Prioritizing outcomes over projects is crucial when developing your plans.

We've tailored a list of OKRs examples for Investor Funding to help you. You can look at any of the templates below to get some inspiration for your own goals.

If you want to learn more about the framework, you can read our OKR guide online.

The best tools for writing perfect Investor Funding OKRs

Here are 2 tools that can help you draft your OKRs in no time.

Tability AI: to generate OKRs based on a prompt

Tability AI allows you to describe your goals in a prompt, and generate a fully editable OKR template in seconds.

- 1. Create a Tability account

- 2. Click on the Generate goals using AI

- 3. Describe your goals in a prompt

- 4. Get your fully editable OKR template

- 5. Publish to start tracking progress and get automated OKR dashboards

Watch the video below to see it in action 👇

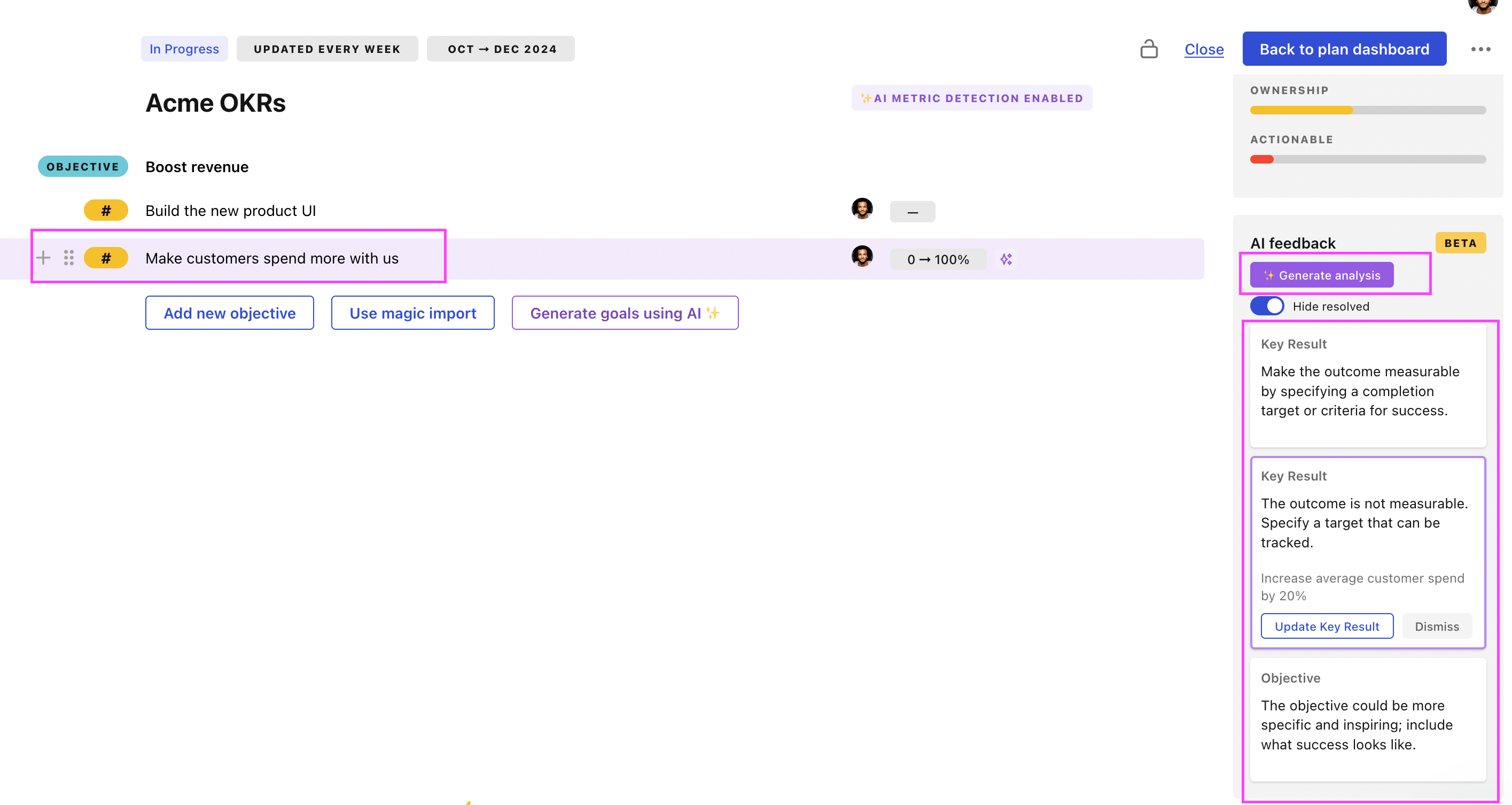

Tability Feedback: to improve existing OKRs

You can use Tability's AI feedback to improve your OKRs if you already have existing goals.

- 1. Create your Tability account

- 2. Add your existing OKRs (you can import them from a spreadsheet)

- 3. Click on Generate analysis

- 4. Review the suggestions and decide to accept or dismiss them

- 5. Publish to start tracking progress and get automated OKR dashboards

Tability will scan your OKRs and offer different suggestions to improve them. This can range from a small rewrite of a statement to make it clearer to a complete rewrite of the entire OKR.

Investor Funding OKRs examples

You'll find below a list of Objectives and Key Results templates for Investor Funding. We also included strategic projects for each template to make it easier to understand the difference between key results and projects.

Hope you'll find this helpful!

OKRs to secure $1 million for the pre-seed funding round

ObjectiveSecure $1 million for the pre-seed funding round

KRIdentify and reach out to 50 potential investors by end of phase 1

Initiate contact with each investor through personalized emails

Research and locate contact information for identified investors

Identify 50 potential investors using business directories or networking

KRAchieve commitment for investment from minimum 50% met investors by final phase

Negotiate and finalize investment commitments from participating investors

Create a compelling presentation for potential investors

Schedule and conduct regular meetings with interested investors

KRSecure meetings with at least 25% of identified investors by phase 2

Create a persuasive investment proposal

Schedule and arrange meetings with identified investors

Identify and research potential investors for pitching

OKRs to secure funding from three new investors

ObjectiveIncrease investor funding

KRSecure funding from at least three new investors

KRCreate a compelling investment pitch

KREstablish new relationships with potential investors

KRSchedule and conduct meetings with interested investors

OKRs to raise 1 Million US Dollars as seed funding

ObjectiveRaise 1 Million US Dollars as seed funding

KRIdentify and pitch to 50 potential investors in targeted industries

Create a comprehensive list of 50 potential investors in targeted industries

Research each investor's interests, prioritizing those aligned with our company

Develop and customize pitches tailored to each potential investor

KRSecure commitments from 10 investors at an average of $100,000 each

Schedule individual meetings to present pitch

Identify 20 potential investors for initial outreach

Prepare a persuasive investment pitch

KRExecute fundraising events/campaigns generating $200,000 in total

Organize high-donor events and peer-to-peer fundraising campaigns

Implement donor stewardship plan to encourage repeat contributions

Develop a comprehensive fundraising strategy targeting a $200,000 goal

OKRs to increase Fuxion company's valuation to $1 billion USD

ObjectiveIncrease Fuxion company's valuation to $1 billion USD

KRGrow global distributor network by 20% to expand sales and product reach

Negotiate contracts and finalize agreements with distributors

Research new potential markets and viable distributors globally

Establish contact and build relationships with identified distributors

KREnhance brand popularity and recognition through strategic marketing campaigns resulting in 30% sales increase

Establish partnerships with social media influencers to promote brand

Develop unique, engaging content for targeted advertising campaigns

Initiate a customer referral program to increase sales

KRSecure $50m in new investor funding to boost capital and financial standing

Develop comprehensive pitch showcasing compelling financial forecasts and growth potential

Negotiate favorable funding terms to maximize capital infusion

Organize strategic meetings with potential high net-worth investors

OKRs to attract €1m for SAFE investment funding

ObjectiveAttract €1m for SAFE investment funding

KRClose at least 10 investment deals ranging €80,000 - €120,000 each

Identify potential investors interested in €80,000 - €120,000 investments

Negotiate and finalize at least 10 investment deals

Develop a compelling presentation showcasing investment opportunities

KRConduct 40 investor presentations to showcase SAFE investment benefits

Schedule and conduct 40 investor presentations

Identify and compile list of potential investors for presentations

Develop compelling presentation material on SAFE investment benefits

KRIdentify and connect with 100 potential investors with interest in SAFE

Develop a tailored pitch for SAFE investment

Research and list 100 potential SAFE investors

Initiate contact with each identified investor

OKRs to boost funding penetration to stride towards the 10% goal

ObjectiveBoost funding penetration to stride towards the 10% goal

KRIncrease funding proposals by 20% attracting new investors

Develop multi-channel marketing strategy for funding proposals

Strengthen network relationships for increased investor interest

Introduce innovative projects to attract fresh investors

KRImprove approval rate of proposals by 30% with persuasive pitches

Improve team skills by organizing frequent sales pitch training

Conduct research on successful strategies for persuasive pitching

Gather feedback and continuously refine the pitch content and delivery

KRMaintain a 10% increase in total funding secured each month

Regularly communicate updates to current investors

Research and identify potential new investors weekly

Develop and refine the pitch deck continuously

OKRs to secure funding for mobile game prototype

ObjectiveSecure funding for mobile game prototype

KRResearch and identify 100 viable investors for gaming prototype by week 6

KRDevelop and perfect a unique and engaging pitch for potential funders by week 3

Identify unique selling points of the project

Practice the pitch for fluid delivery

Create a compelling narrative for the pitch

KRSecure meetings and present pitch to at least 50% of identified investors

Prepare and rehearse investor pitch

Compile contacts of identified investors

Schedule meetings with each investor

OKRs to launch a high growth and profitable tech startup

ObjectiveLaunch a high growth and profitable tech startup

KRDevelop a minimum viable product, tested and approved by a focus group of 25 participants

Create and test the product with focus group

Implement changes based on feedback

Identify key features for the minimum viable product

KRSecure funding worth at least $1M from reliable investors

Schedule and conduct persuasive pitch meetings with investors

Develop a compelling business proposal showcasing ROI

Research and create a list of potential reliable investors

KRAssemble a cohesive team of 5 skilled professionals for key operations

Identify required skills for key operations team roles

Source potential candidates through networking or recruiting

Conduct interviews and select final team members

Investor Funding OKR best practices

Generally speaking, your objectives should be ambitious yet achievable, and your key results should be measurable and time-bound (using the SMART framework can be helpful). It is also recommended to list strategic initiatives under your key results, as it'll help you avoid the common mistake of listing projects in your KRs.

Here are a couple of best practices extracted from our OKR implementation guide 👇

Tip #1: Limit the number of key results

Focus can only be achieve by limiting the number of competing priorities. It is crucial that you take the time to identify where you need to move the needle, and avoid adding business-as-usual activities to your OKRs.

We recommend having 3-4 objectives, and 3-4 key results per objective. A platform like Tability can run audits on your data to help you identify the plans that have too many goals.

Tip #2: Commit to weekly OKR check-ins

Having good goals is only half the effort. You'll get significant more value from your OKRs if you commit to a weekly check-in process.

Being able to see trends for your key results will also keep yourself honest.

Tip #3: No more than 2 yellow statuses in a row

Yes, this is another tip for goal-tracking instead of goal-setting (but you'll get plenty of OKR examples above). But, once you have your goals defined, it will be your ability to keep the right sense of urgency that will make the difference.

As a rule of thumb, it's best to avoid having more than 2 yellow/at risk statuses in a row.

Make a call on the 3rd update. You should be either back on track, or off track. This sounds harsh but it's the best way to signal risks early enough to fix things.

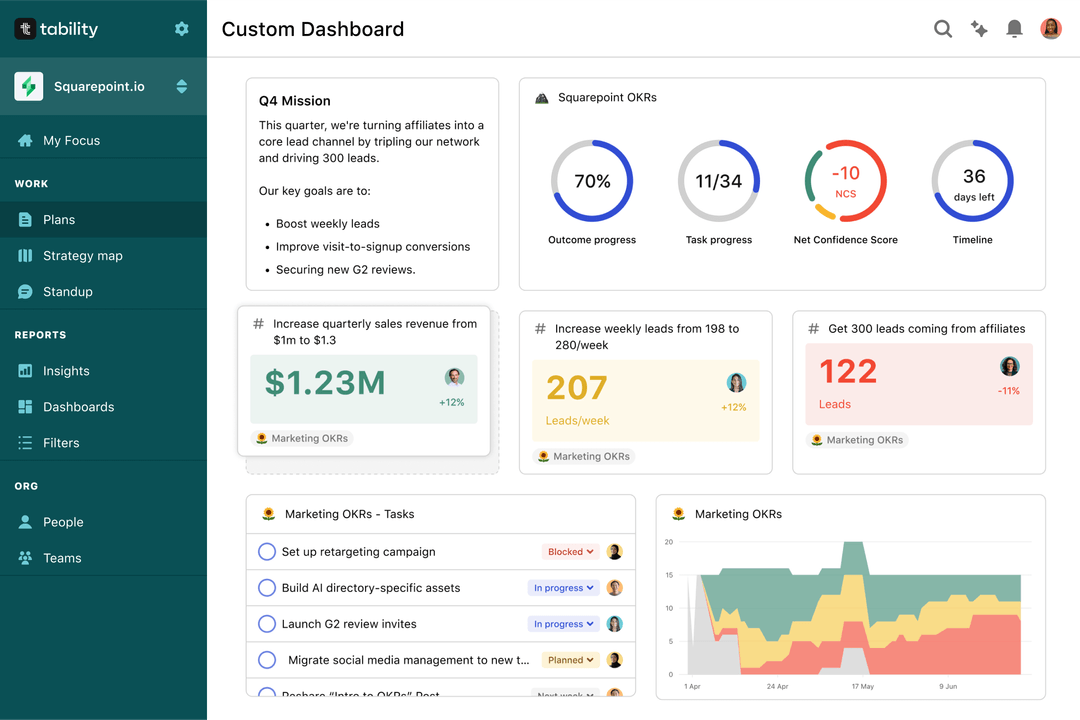

Save hours with automated Investor Funding OKR dashboards

Your quarterly OKRs should be tracked weekly if you want to get all the benefits of the OKRs framework. Reviewing progress periodically has several advantages:

- It brings the goals back to the top of the mind

- It will highlight poorly set OKRs

- It will surface execution risks

- It improves transparency and accountability

Most teams should start with a spreadsheet if they're using OKRs for the first time. Then, you can move to Tability to save time with automated OKR dashboards, data connectors, and actionable insights.

How to get Tability dashboards:

- 1. Create a Tability account

- 2. Use the importers to add your OKRs (works with any spreadsheet or doc)

- 3. Publish your OKR plan

That's it! Tability will instantly get access to 10+ dashboards to monitor progress, visualise trends, and identify risks early.

More Investor Funding OKR templates

We have more templates to help you draft your team goals and OKRs.

OKRs to enhance visual uniformity throughout multiple platforms

OKRs to achieve As and Bs in English class next quarter

OKRs to increase client retention for enhanced repeat business

OKRs to achieve a 90% service level performance

OKRs to secure optimal pricing from third-party vendors

OKRs to generate a comprehensive audience engagement strategy